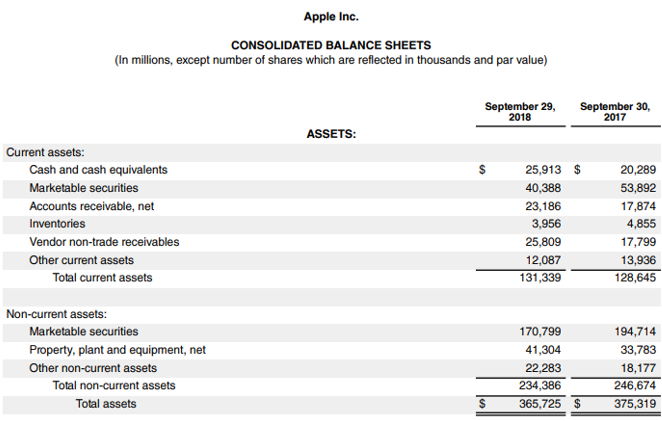

Each of these eventually adjusts your gross AR, reducing that total to show a truer, collectible value. The net accounts receivable formula, by considering these factors, provides a more accurate picture of a company’s upcoming cash flow, enabling better financial planning and decision-making. Financial statements require companies to report net accounts receivable because it provides a more accurate picture of a company’s financial health. It reflects the money that the company is likely to turn into cash in the near future. Net receivables are shown as an aggregated total on the company’s balance sheet.

Key Takeaways

- That’s why we’re going to walk you through how to calculate accounts receivable in this guide.

- This metric provides the average number of days it takes to collect an outstanding invoice after a sale has been made.

- Follow this step-by-step guide to accurately determine your business’s average net accounts receivable.

- The concept is used in a number of liquidity ratios (especially the accounts receivable turnover ratio).

- Trending the average AR balance itself also provides insights on working capital efficiency.

Net credit sales also incorporates sales discounts or returns from customers and is calculated as gross credit sales less these residual reductions. Think of it as a realistic view of what your accounts receivable figure will actually turn into in cash once all customer payments are processed. Subtracting the allowance amount from the total accounts receivable shows a more realistic picture of the money the company actually expects to collect—the net accounts receivable. This helps avoid overestimating their available cash and ensures the balance sheet reflects a more accurate financial picture. Accounts Receivable is the total amount of money owed to your business by your customers from sales on account.

Average net accounts receivable formula

It boosts creditworthiness, essential for securing loans or attracting investors. Instead of immediate cash exchange after a sale, you extend a line of credit, offering your customers time to pay. This $92,000 is what the company realistically expects to collect from its customers. By implementing these strategies, you can tighten your collections practices, reduce bad debt risk, and achieve a more favorable net A/R ratio.

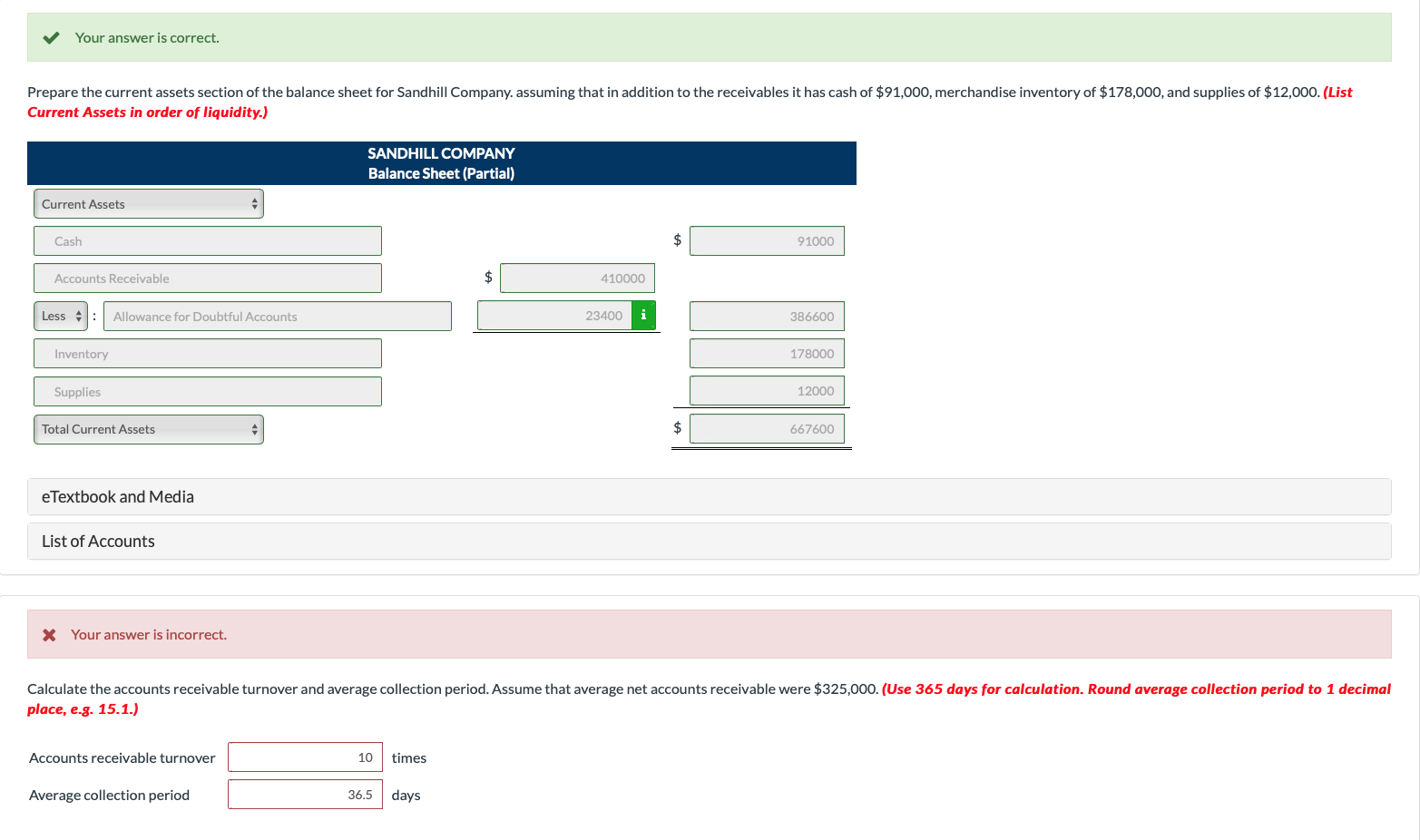

Example of Net Accounts Receivable

For more context, net credit sales are those made on credit minus any returns or allowances. Average accounts receivable, as you name now, is derived from the sum of the beginning and ending accounts receivable for a period divided by two. We can interpret the ratio to mean that Company A collected its receivables 11.76 times on average that year.

A high ratio can also suggest that a company is conservative when it comes to extending credit to its customers. Conservative credit policies can be beneficial since they may help companies avoid extending credit to customers who may not be able to pay on time. Assume that your company has a gross AR of $15,000 for the sale of a batch of electronic goods.

Step 3: Calculate the Average

This inaccuracy skews results as it makes a company’s calculation look higher. When evaluating an externally-calculated ratio, ensure you understand how the ratio was calculated. Comparing these ratios over time and to industry benchmarks reveals improvement or deterioration in managing accounts receivable. Trending the average AR balance itself also provides insights on working capital efficiency. NAR analysis will help in identifying either patterns in non-paying customers or weaknesses in the collection process, thus offering insights to improve cash flow. Receivables turnover ratio is a measure of how effective the company is at providing credit to its customers and how efficiently it gets paid back on a given day.

The accounts receivable turnover ratio measures the number of times a company’s accounts receivable balance is collected in a given period. A high ratio means a company is doing better job at converting average net receivables credit sales to cash. However, it is important to understand that factors influencing the ratio such as inconsistent accounts receivable balances may inadvertently impact the calculation of the ratio.

The gross receivables are listed first and are followed by the allowance for doubtful accounts. The allowance for doubtful accounts is a contra-asset account, as it reduces the balance of an asset. The allowance for doubtful accounts is a company’s estimate of the amount of the accounts receivable it anticipates will not be collectible and will need to be recorded as a write-off. This estimate is subtracted from the gross amount of outstanding accounts receivable. The two main methods for estimating the allowance for doubtful accounts are the percentage of sales method and the accounts receivable aging method. In the long run, you can compare your average collection period with other businesses in the same field to observe your financial metrics and use them as a performance benchmark.