Marginal costing evaluates the impact on cost by adding one additional unit into production. In an ideal setting, one would try to produce at the right-most edge of a fixed-cost step. This squeezes maximum productive output from a given level of expenditure. However, for a business with many fixed costs, it is more challenging to orchestrate operations so that each component is fully utilized. For example, one employee might be able to operate three machines but only two are in use. It seems simple to assume that a third machine should be installed but that might require additional building space.

Practice Questions

The following graphs show how the fixed cost per unit will decline with increases in production. This attribute of fixed costs is important to consider in assessing the scalability of a business. It is important to remember that even though Tony’s costs stepped up when he exceeded his original capacity (relevant range), the behavior of the costs did not change. His fixed costs still remained fixed in total and his total variable cost rose as the number of T-shirts he produced rose. Unlike fixed costs that remain fixed in total but change on a per-unit basis, variable costs remain the same per unit, but change in total relative to the level of activity in the business. Revisiting Tony’s T-Shirts, Figure 6.26 shows how the variable cost of ink behaves as the level of activity changes.

How much will you need each month during retirement?

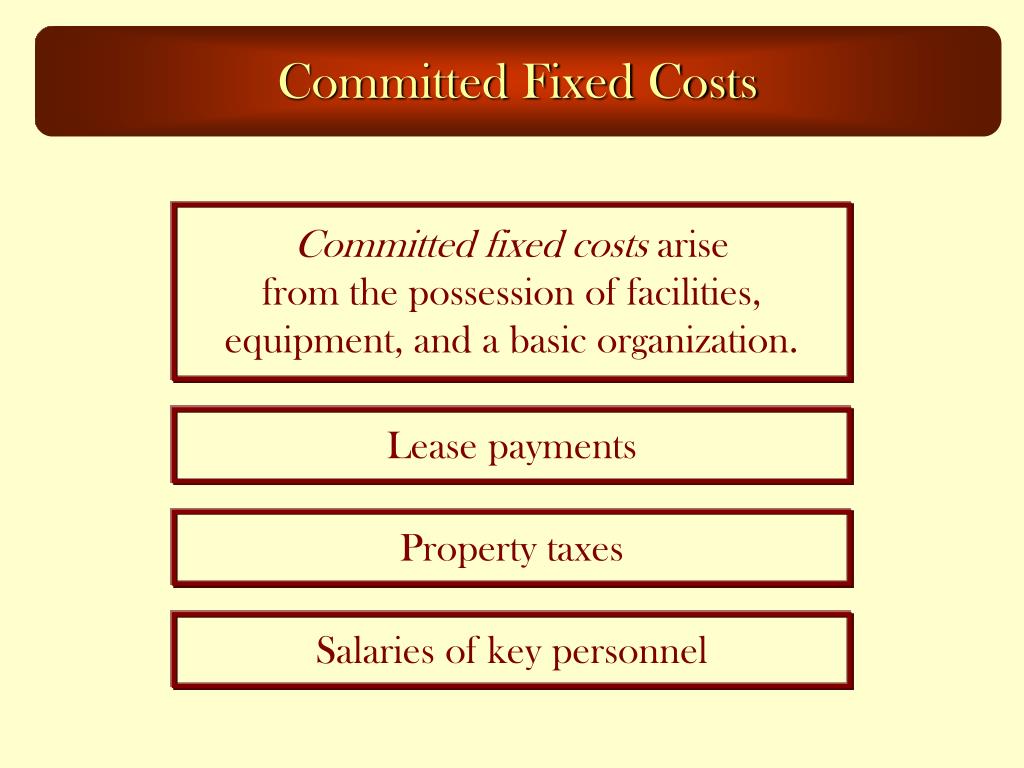

- Since these costs are not directly influenced by changes in production or sales volume, they remain relatively constant in the short term.

- Non-payment of committed costs can have significant impact as it can result in disruption of business activities.

- Software applications, such as Excel, can use regression analysis to estimate fixed and variable costs.

- It is important for Bert to know what is fixed and what is variable so that he can control his costs as much as possible.

- A decision to terminate agreements of this nature often lead to the loss of income due to penalties.

Due to its failed launch, the $50,000 spent on advertising would be considered a sunk cost. In order to qualify for a loan or gain approval from a board of directors, you’ll likely need a budget and a business plan. The plan serves as the financial road map for your company in the years to come.

Key Equation

The interplay between all of the different costs emphasizes the importance of good planning. The trick is to synchronize operations so that the benefits of each fixed cost are maximized, reporting 529 plan withdrawals on your federal tax return and variable cost patterns are established in the most economic position. All of this must be weighed against revenue opportunities; one must be able to sell what is produced.

Variable Costs

Although the scattergraph method tends to yield more accurate results than the high-low method, the final cost equation is still based on estimates. The line is drawn using our best judgment and a bit of guesswork, and the resulting y-intercept (fixed cost estimate) is based on this line. However, the next approach to estimating fixed and variable costs—regression analysis—uses mathematical equations to find the best-fitting line. If the company hires a second quality inspector, they would be stepping up their fixed costs.

However, those components have become more affordable, and there is now more outsourcing, elimination of employee benefits, and so forth. These activities suggest attempts to structure businesses with a definitive margin that scales up and down with changes in the level of business activity. The activity base is the item or event that causes the incurrence of a variable cost. It is easy to think of the activity base in terms of units produced, but it can be more than that. But, the material used for fillings is a variable that is tied to the number of decayed teeth that are repaired. Each variable cost must be considered independently and with careful attention to what activity drives the cost.

Note that regardless of the activity level, total fixed costs remain the same. Table 5.2 provides the total and per unit fixed costs at three different levels of production, and Figure 5.2 graphs the relation of total fixed costs (y-axis) to units produced (x-axis). A variable cost1 describes a cost that varies in total with changes in volume of activity. The activity in this example is the number of bikes produced and sold. However, the activity can take many different forms depending on the organization.

Once the boundary of the relevant range has been reached or moved beyond, fixed costs will change and then remain fixed for the new relevant range. Let’s examine an example that demonstrates how changes in activity can affect costs. It requires the application of labor to the raw materials and component parts. You’ve also learned that direct labor is the work of the employees who are directly involved in the production of goods or services. In fact, for many industries, the largest cost incurred in the production process is labor.

In practice, the classification of costs changes as the use of the cost data changes. In fact, a single cost, such as rent, may be classified by one company as a fixed cost, by another company as a committed cost, and by even another company as a period cost. Understanding different cost classifications and how certain costs can be used in different ways is critical to managerial accounting. Now that we have identified the three key types of businesses, let’s identify cost behaviors and apply them to the business environment.